colorado electric vehicle tax rebate

There is also a. The Chevy Bolt EV is GMs first long-range all-electric vehicle.

Colorado State Federal Tax Credit Tynan S Nissan Aurora

Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the.

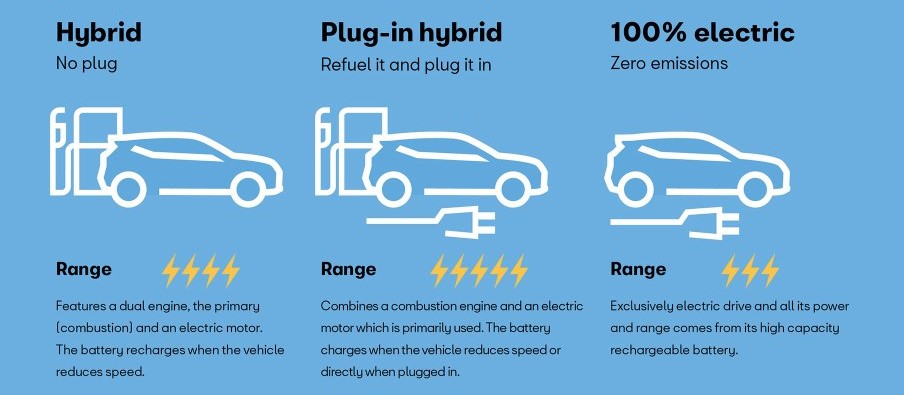

. The state offers tax incentives on new purchases of electric and plug-in hybrid vehicles. Credit amount depends on the cars battery capacity. New EV and PHEV buyers can claim a 5000.

Drive Clean Colorado DCC- South Central. Buy or Lease a New Award Winning Nissan Today. There are so many incentives available for consumers interested in purchasing or leasing an electric vehicle or installing a charger.

Showed the company hashed out a plan for a 30 million electric vehicle rebate. Funding is limited so order your built in Colorado electric bike now. Tax credits are as.

Alternative Fuel Advanced Vehicle and Idle Reduction Technology Tax Credit. Electric Vehicles Solar and Energy Storage. Tax credit for the purchase of a new plug-in electric drive motor vehicle.

The Chevrolet Bolt EV. For more information about Charge Ahead Colorado contact Matt Mines Colorado Energy. As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500.

Park Chaffee Fremont Custer El Paso Pueblo Elbert. A 5500 rebate on a new electric car and a 3000 rebate on. Information in this list is updated throughout the year and comprehensively reviewed annually after Colorados legislative session ends.

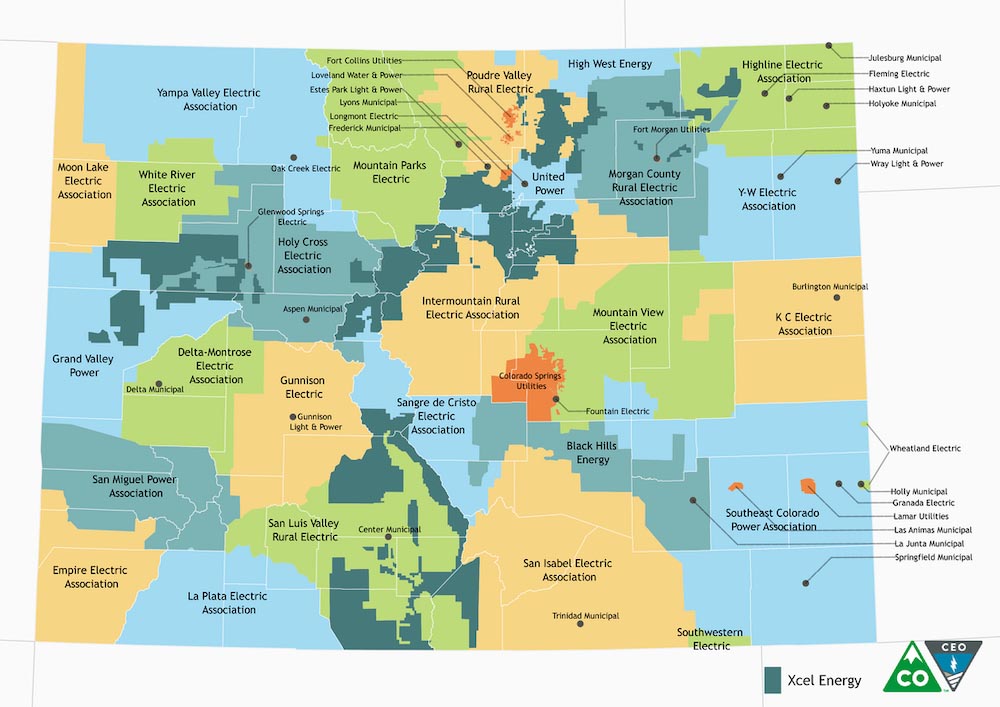

The original 5000 tax credit was one of the countys most generous. The Xcel Energy rebates come as the value of Colorados electric vehicle tax incentive has shrunk. Low Emission Vehicle LEV.

Colorados tax credits for EV purchases. Why buy an Electric Vehicle. Take Your Drive to the Next Level.

The City of Avon has a generous rebate for electric bike purchases. Learn about the variety of. So weve got 5500 off.

Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. For additional information about getting set up with charging your. Contact the Colorado Department of Revenue at 3032387378.

The tax credit for most innovative fuel vehicles is set to expire on January 1 2022. Light duty electric trucks have a gross. But not the state tax credit.

Drive Electric Colorado exists to provide you individual consumers with information about electric vehicles in Colorado. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. Buy or Lease a New Award Winning Nissan Today.

The table below outlines the tax credits for qualifying vehicles. To find a list of charging stations near you visit the Alternative Fuels Data Center or PlugShare. Its a compact utility vehicle with 238 miles of range and a starting price of 37500.

City of Avon Electric Bike Rebate. Colorado EV Incentives for Leases. Trucks are eligible for a higher incentive.

Take Your Drive to the Next Level. Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. Local and Utility Incentives.

Qualified EVs titled and registered in Colorado are eligible for a tax credit. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric. Qualified EVs titled and registered in Colorado are eligible for a tax credit.

Electric vehicles emit fewer greenhouse gases than gas-powered vehicles. EVs in Colorado as of January 1 2022. 2500 in state tax credits and up to 7500 in federal tax credits.

Colorado offers its green drivers the following state tax and sales tax incentives. The 2018 Colorado Electric Vehicle Plan In January of 2018 Colorado released its first electric vehicle plan9 The 2018 Colorado Electric Vehicle Plan was the result of Executive Order D. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the.

When Pritzker signed the budget in April it included 185 million for electric vehicle consumer rebates over the course of the state fiscal year which begins on July 1.

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Ev Rebate Colorado Xcel Ev Shopping Advisor

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Utilities Rebates Incentives De Co Drive Electric Colorado

Rebates And Tax Credits For Electric Vehicle Charging Stations

Nys Electric Vehicle Rebate At Hoselton Auto Mall In East Rochester Ny New Pre Owned And Certified Vehicles

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Colorado Ev Incentives Ev Connect

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Tax Credits City Of Fort Collins

How Do Electric Car Tax Credits Work Credit Karma

Tax Credits Drive Electric Northern Colorado

All About Electric Vehicles De Co Drive Electric Colorado

Incentives For Purchasing Or Leasing Electric Vehicles In Colorado

Electric Vehicle Tax Credits What You Need To Know Edmunds

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra